What is the ageing and lifestyle theme?

Ageing and lifestyle describes the changing ways that people are living across the globe as life expectancies rise. Ageing populations are one of the greatest social, economic and political transformations of our time.

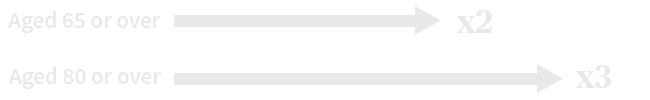

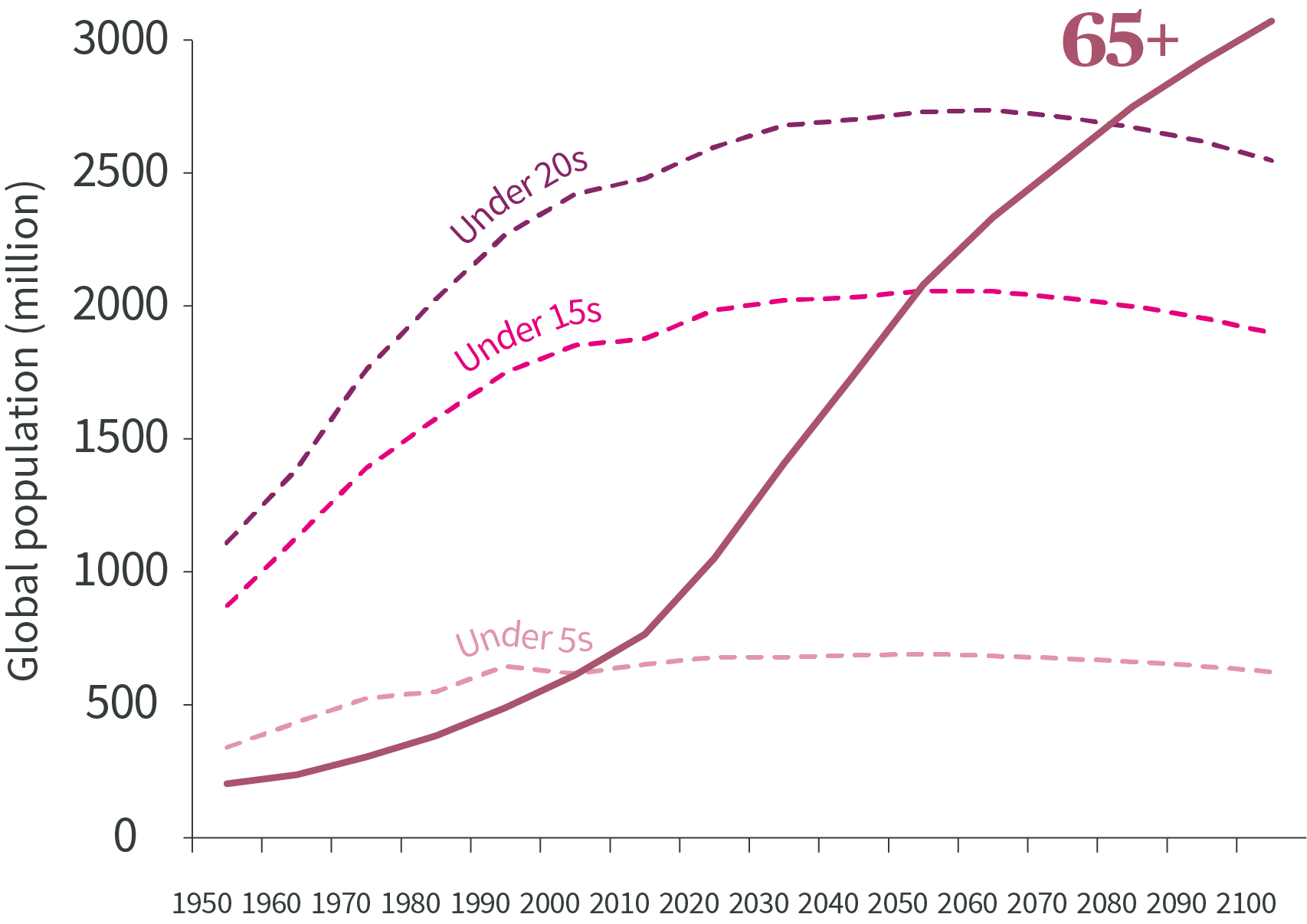

For example, the global 60+ cohort is forecast to grow significantly faster than all other age groups – tripling in size between 2000 and 2050 - creating challenges and opportunities for governments, companies and individuals alike.

Forecasted change in global population size between 2000 and 2050

Source: World Population Ageing, United Nations, 2020; World Health Organisation, October 2021

What are the potential benefits of the ageing and lifestyle theme?

The investible opportunities of ageing populations extend far beyond the obvious areas of healthcare. The changing lifestyles and needs of older generations could represent a multi-decade growth opportunity for investors. By 2030, two-thirds of over-60s’ consumption growth in developed markets will be spent across multiple industries dedicated to living well, from beauty and fitness, to travel and entertainment1

.

Meanwhile other industries like real estate, financials and healthcare will have to rapidly adapt to retiring and elderly generations’ needs.

We invest in companies operating across four areas associated with the economic implications of longevity:

- Silver spending: Industries dedicated to living well; beauty/aesthetics, personal care, fitness, housing, travel, leisure and entertainment.

- Treatment: Companies seeking sustainable treatment solutions for the coming generations.

- Wellness: The wellness industry includes preventative medicine, personalised treatments, nutrition, beauty and anti-ageing treatments.

- Senior care: Markets for senior housing and specialist assisted living facilities, such as Memory Care that focuses on dementia patients.

- VW5pdGVkIE5hdGlvbnMsIGRhdGEgY29ycmVjdCBhcyBhdCBKdWx5IDIwMjA=

The global number of adults aged 65+ now outnumber children under 5.

Source: United Nations, data correct as at January 2022

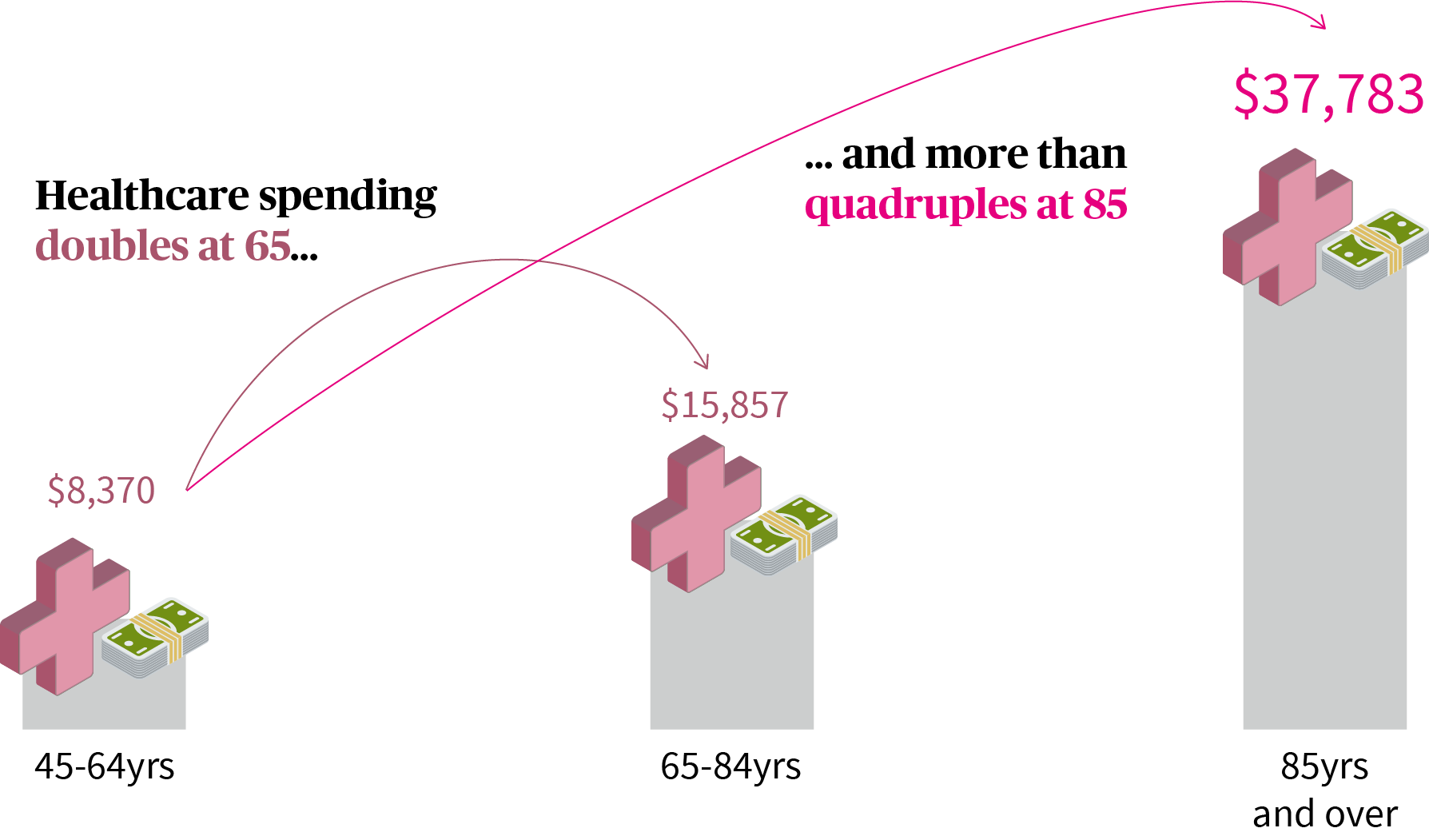

Living longer naturally incurs higher healthcare costs; preventing and treating age-related chronic diseases will be key driver of healthcare spending over next five years. 10,000 Americans hit the age of 65 every day, at which point personal healthcare spending doubles2 .

Source: US Centres for Medicare & Medicaid Services

- SGVhbHRoLWNhcmUgZGlsZW1tYTogMTAsMDAwIGJvb21lcnMgcmV0aXJpbmcgZWFjaCBkYXksIENOQkMsIDMgT2N0b2JlciAyMDE3

That means an additional $28bn of deficit each day, according to the World Economic Forum3 . The increasing onus for individuals to save for, and enjoy, longer retirements gives wealth managers opportunity in an underpenetrated market.

- SW52ZXN0aW5nIGluIChhbmQgZm9yKSBPdXIgRnV0dXJlIOKAkyBXb3JsZCBFY29ub21pYyBGb3J1bSwgSnVuZSAyMDE5

To help people invest in the companies that are embracing these changes, we have adapted our internal research capabilities to incorporate the five main trends that we believe represent the future for long-term fundamental growth investing.

Automation

Forecast to grow 10-15% annually until 20254, the robotics industry is rapidly changing how we live and work.

Connected consumer

Only 18%5 of global retail sales are transacted online, which will likely increase as smartphone adoption rises globally.

Clean Economy

Innovative companies are creating solutions to address pressures on scarce natural resources and the need for greenhouse gas emission reduction.

Transitioning societies

The growth of the global middle class is at a 150-year high6, boosting consumption in Asia and in the developing world.

Disclaimer

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

All investment involves risk , including the loss of capital . The value of investments and the income from them can fluctuate and investors may not get back the amount originally invested.