China Outlook – Short-term reprieve, long-term challenges

Key points

- 2023 – the first-year post-pandemic – endured a sluggish first half due to wavering confidence and delayed policy boosts. Stimulus has quickened the pace since

- 2024 is expected to grow at a faster quarterly pace, backed by supportive measures and eventually firmer external demand

- But the economic upswing from announced stimuli looks set to fade into 2025 and could lead to future imbalances, requiring a potentially prolonged adjustment period

Free from COVID-19 disruptions but marked by scars

China’s harsh zero-COVID policy was lifted at the end of December 2022. 2023 was the first year without COVID-19 disruptions. However, the economic recovery faced hurdles. Despite an initial rebound in the first quarter (Q1), several headwinds emerged, exerting pressure on the economy. Somewhat delayed but solid stimulus measures have supported the economy, positioning it well to meet this year's growth target of "around 5%”.

The three-year rollercoaster of pandemic restrictions and real estate turmoil have eroded public confidence, evident in weak prices, subdued consumption and sluggish investment in the first half of the year. Beijing began acting in August, unveiling substantial policy support – particularly in mortgage easing – aimed at stimulating housing demand and alleviating household financial pressures.

The outlook for China’s economy appears to hinge critically on the central government going forwards. Should it provide adequate and timely supports to meaningfully restore consumer and investor confidence, we would anticipate a brighter 2024 and a more stable 2025.

Investment is transmission of stimulus

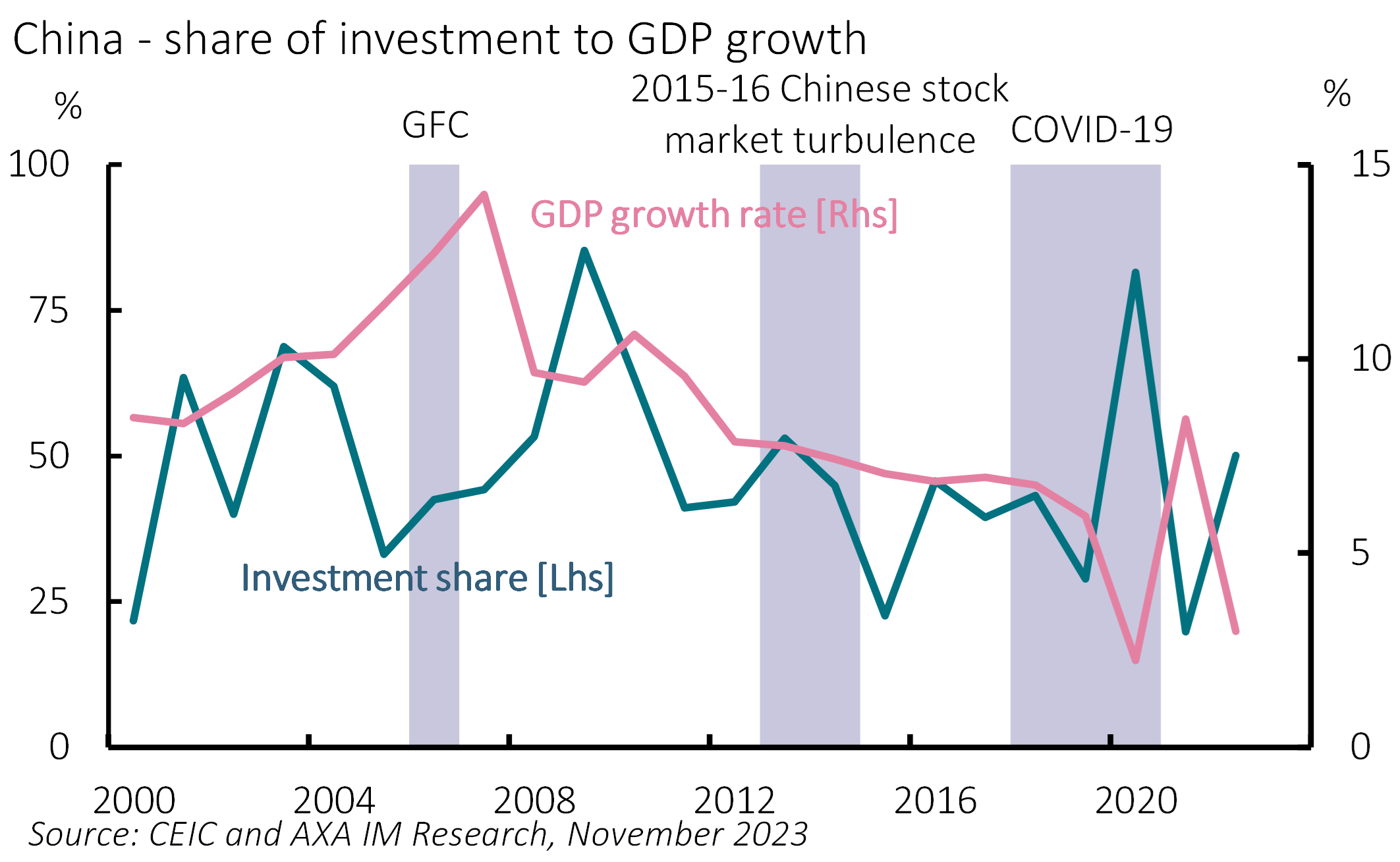

According to Beijing’s conventional economic doctrine, investment, consumption, and exports are the ‘three carriages’ driving economic growth. When the economy experiences sluggishness, stimulus-backed investment has typically become the marginal policy tool to support growth (Exhibit 1). This time has been no exception. In July, Beijing mandated the acceleration of Local Government Special Bonds issuance. In October, the unusual mid-year budget review surprised markets by adding one trillion renminbi to the budget deficit. Alongside the early issuance of next year’s quota for Local Government Bonds (LGB), these directives aim to bolster investment, providing more support as we move into 2024.

Historically, stimulating investment through LGB issuance funnels spending into infrastructure projects, which typically have extended timelines. Consequently, the impact of such stimulus is not immediate but rather gradual. We anticipate continuous investment support throughout 2024, thereby sustaining the economy.

Exhibit 1: Investment has saved GDP growth several times

Exports are to follow

This year presented formidable challenges for China’s exports, due to global inflation and reduced consumer spending in developed countries. Despite this, certain sectors like mechanical and electrical products and automobiles held up well, with China even surpassing Japan to become the world’s top auto exporter, driven by its growing electric vehicle exports since 2018.

As part of its ‘industrial upgrading’ initiative, China aims to boost high-value manufacturing in its exports. Looking ahead, as inflation eases in developed economies, global demand is expected to recover, potentially improving China’s export situation by late 2023 into 2024 and beyond. However, uncertainty looms due to geopolitical dynamics. Any stringent restrictions from the US or European Union could significantly impact China’s exports and its manufacturing sector. The recent Asia-Pacific Economic Cooperation (APEC) meeting between Presidents Joe Biden and Xi Jinping suggested a thawing in relations, with the US lifting some restrictions, including on a key China agency. However, next year’s US elections could lead to a swift reversal of this warming.

Consumption relies on the property market

China is a nation of homeowners. A 2020 study

Since the property market turmoil began in 2021, Chinese households have fretted over asset values, leading to muted consumption and a persistent increase in precautionary saving. This behaviour is not purely reflective of mortgage payments impacting incomes, but rather to compensate the financial insecurity resulting from property devaluation – a wealth effect. Therefore, stabilising the property market is crucial to bolster consumer confidence and underpin consumption.

Efforts have been made since August on monetary and fiscal fronts to alleviate pressure on household finances and enhance housing demand. However, addressing the structural issues in the property sector will be a long journey, which is now only at the start. Continuous government support is vital not only for housing market stability, but to prevent prolonged repercussions on related sectors like construction and private consumption.

Our base view is Beijing will implement adequate measures to support the demand side of the housing market over the coming two years, allaying concerns among households. As the services sector and labour market recover, consumer confidence should rise across 2024. Consequently, improved sentiment and reduced fluctuations in pork prices should enhance consumer prices moving forward. We expect Consumer Price Index inflation to average 1.1% in 2024, before reaching 2% in 2025.

Policy supports now risk future problems

The economy requires policy backing to avert a severe downturn. However, Beijing’s strategy mirrors past investment-driven growth models. While historical data are testimony to the short-term effectiveness, it bears future costs. The bulk of local government investments inevitably funnel into infrastructure projects, which mainly provide public goods, typically yielding low returns. This situation strains local government balance sheets. Although the central government has recently indicated willingness to assume more debt on behalf of local governments, it perpetuates a cycle of ‘more debt, more investment, low return’, exacerbating resource misallocation.

Yet this investment-centric model (Exhibit 2) is Beijing's most familiar and seemingly most-favoured option. Direct fiscal stimulus to households has never been used, with no established channels for such delivery and questions over its effectiveness without a reversal in public confidence.

In 2024, China is expected to prioritise addressing the challenges posed by property market woes and local government indebtedness. Coordinating fiscal and monetary tools for economic support is likely the approach. We expect this to prompt faster quarterly growth in 2024, followed by a slowdown in 2025 as the stimulus effects wane. We estimate annual growth to peak at 4.5% in 2024 before easing to 4.2% in 2025.

Exhibit 2: When re-balancing will be back to agenda

Structural reform is the solution in the long run

The impressive ‘Chinese speed’ of economic growth over the past 40 years owes its success to several key factors: the demographic dividend; World Trade Organization accession; East Asian reshuffling; and, underpinning these, structural reform. The economic reforms of former leader Deng Xiaoping in 1978 spurred China’s current economic and global influence. Policy stimulus effectively tackles cyclical issues, providing short-term boosts, but long-standing structural issues resurface when this support wanes – a challenge acknowledged by Beijing. The critical question remains – can it relinquish its grip and embark on much-needed structural reforms? Based on President Xi’s recent behaviour, we have our doubts.

Disclaimer

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

It has been established on the basis of data, projections, forecasts, anticipations and hypothesis which are subjective. Its analysis and conclusions are the expression of an opinion, based on available data at a specific date.

All information in this document is established on data made public by official providers of economic and market statistics. AXA Investment Managers disclaims any and all liability relating to a decision based on or for reliance on this document. All exhibits included in this document, unless stated otherwise, are as of the publication date of this document.

Furthermore, due to the subjective nature of these opinions and analysis, these data, projections, forecasts, anticipations, hypothesis, etc. are not necessary used or followed by AXA IM’s portfolio management teams or its affiliates, who may act based on their own opinions. Any reproduction of this information, in whole or in part is, unless otherwise authorised by AXA IM, prohibited.

Neither MSCI nor any other party involved in or related to compiling, computing or creating the MSCI data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such data. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any third party involved in or related to compiling, computing or creating the data have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. No further distribution or dissemination of the MSCI data is permitted without MSCI’s express written consent.

AXA IM and BNPP AM are progressively merging and streamlining our legal entities to create a unified structure

AXA Investment Managers joined BNP Paribas Group in July 2025. Following the merger of AXA Investment Managers Paris and BNP PARIBAS ASSET MANAGEMENT Europe and their respective holding companies on December 31, 2025, the combined company now operates under the BNP PARIBAS ASSET MANAGEMENT Europe name.