Back to which future?

It would be extraordinary if advanced economies had reverted to the price and wage setting behaviours of forty years ago in the space of just one year. It is true that global price shocks have been followed by some second round effects as core inflation and wage growth is higher. But it is too early to say that we are permanently in a higher inflation environment (meaning inflation rates in a persistent range of at least 2%-4% or higher). Yet there could be more differentiation across economies as structural differences result in different inflation performances. If so, we should expect more currency and rate volatility. If, however, the default is the competitiveness and technology disruption of the last decade, inflation will fall back. In which case bond yields, at least in the US, don’t look too bad.

A year of inflation

We have now had more than 12 months of data showing the US core personal consumption deflator being above 2.0%. The index has been the Federal Reserve’s (Fed) preferred measure of inflation and 2.0% has been its medium-term target. It has not been as high as it currently is since the 1980s. On a long-term time series chart, the current situation looks like a significant jump in the inflation rate, but the 5-year average is still just 2.1% and, conceivably, the spike in inflation could be largely related to the dislocations in the world economy caused by the pandemic and, more recently, the Russian invasion of Ukraine. The counter-factual is impossible to know but would inflation be this high if it wasn’t for COVID and Putin?

And the response is coming

The counter-factual doesn’t matter. The reality is that inflation is high. So, a lot of the commentary is around “regime” change. Regime suggests an organised system of managing a situation (political or economic) and it is perhaps too early to say whether the regime (monetary policy) is permanently changing in response to changed conditions. If inflation is going to be higher going forward, then the monetary policy regime has to change from one that was geared towards generating inflation to one that is geared towards collapsing inflation. Textbook economics would say that if inflation is now a result of economies moving into a positive output gap then the remedy is to bring demand down to below potential. Straight talking that means lower GDP growth and higher unemployment. So one adaption of the new regime thesis is that central banks have to raise rates enough (and tighten monetary conditions more generally) to achieve lower growth and higher unemployment. There is no guarantee that the current implied peak in interest rates is sufficient to do that.

Everywhere

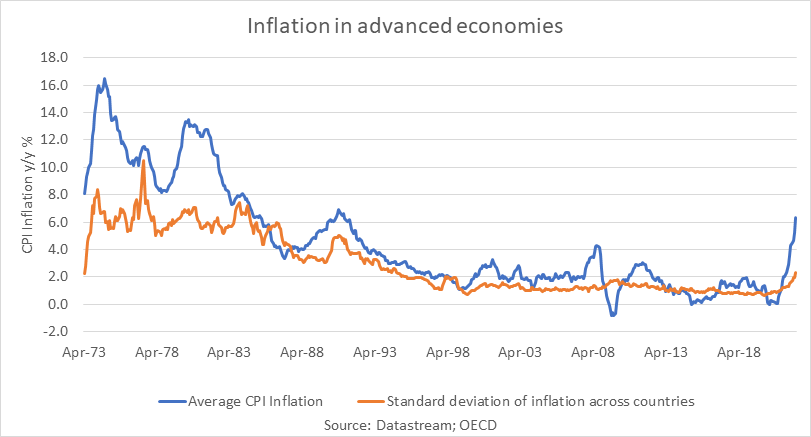

Inflation is going up everywhere. Across OECD countries, the average consumer price inflation rate has jumped to above 6% (March 2022). At the same time, dispersion between countries is also slowly rising. Dispersion is not as high as it was pre-1990 but it has picked up, suggesting differentials in recent inflation performance across countries. So far we are still in an inflation condition where the principal drivers are global and impacting on all countries. Dispersion is still relatively low compared to the 1970s and 1980s (see Chart below). If that remains the case, then when global price influences subside (energy, supply shortages) overall inflation will move back down close to its previous range.

Chart1: Inflation rising in advanced economies

Have things moved that quickly?

It would be a stretch to think that all countries had suddenly reverted to a higher inflation dynamic; a model whereby inflationary cost pressures are rapidly passed via second round effects to broader price and wage increases. It would be a stretch to think that institutional price/wage behaviour is moving simultaneously and quickly away from the low inflation regime of the last twenty years. Is it feasible that all the reasons that contributed to low inflation over the last two decades or so – digitalisation, the gig-economy (reduced labour power), demographics, globalisation – have disappeared in a puff of higher petrol prices? It is too early to say but it pays to keep an open mind even if you might be described as an inflation denier.

Differentiation would mean more FX and rate volatility

However, it is plausible there will be more differentiation in the inflation performance of countries if the big global principal inflation components are higher and more volatile. Higher inflation rates could be more embedded in some countries and better managed in others – as has been the case in the past. Greater differentials in inflation performance would have implications for how currencies behave and would mean more significant interest rate differentials across currencies. Those less able to manage inflation might seek weaker currencies for competitive reasons. The UK could be an economy where inflation becomes more embedded (anecdotally that appears to be the case at the moment, but I will let more considered analysis support or disprove that). If so, a sterling crisis is on the cards at some point.

Back to which future?

Much depends on collective economic behaviour. If the collective trait is to revert to the inflation dynamics of the 1970s and 1980s then there will be more differentiation across economies and also different policy responses. This in turn would loosen correlations between bond markets and possibly equity market performance. International and currency diversification might become a more important investment strategy. It might also restore more of a negative correlation between real rates and risk assets. If, however, the collective behavioural trait is the one learned since the early 1990s, then inflation could quickly return to the 2%-3% norm. Global and domestic competitive forces would prevail while digitalisation and automation would continue to make capital more attractive than labour. In order to understand which way, we are going we need to continue to watch what happens with core inflation and wages.

Real rates forward

Looking at today’s levels of interest rates and prevailing inflation rates gives the illusion that real interest rates are deeply negative. It is more rational is to look at both the cost of money and the cost of goods and services in a forward looking way. If you borrow money today then the interest rate applies to the cost of that credit going forward – interest payments come out of future income. So, what you should be concerned about is what happens to future income (prices). Is inflation going to remain at 8%? Or will it fall over the next year? The current prime lending rate at US banks is 3.5% and the current consensus inflation rate for Q2 2023 is 2.3%. So real rates are positive in this case. If real rates are already starting to be positive when considered against future inflation, then we should start to see credit and economic growth slowing in the months and quarters ahead.

US fixed income more attractive despite more hawkish Fed

Can we apply the same logic to fixed income investing? Current yields – implying the rate of return over the next year – are only attractive if inflation is going to fall. On the basis of the current consensus inflation forecast, 10-year Treasury yields to maturity are in positive territory, but UK gilts and German bunds are not yet. The consensus forecasts are for US inflation to fall more quickly than in Europe, which supports the continued strength of the dollar and the preference for US fixed income. In high yield and credit, prospective total returns in the US market are higher than the current inflation forecast for the next year. It’s not all bad in bond land.

Gen-X’s or Grandparents’ inflation? We don’t know but rates are still going up

Having said all that, the global economic outlook has never before been shaped by the effects of a rapid recovery from a pandemic, ongoing supply issues, a European war and an existential need to shift the basis of most economic activity away from a two century-long dependence of fossil fuels. It would not be a surprise if inflation is going to be higher and more volatile. What is not clear is whether inflation becomes institutionalised as it was in the 1970s and 1980s when wage increases were sought by collective bargaining and when indexation was rife in price setting. In the UK there have been some early signs of a potential supermarket price war and disruptive technologies are surely going to provide opportunities for firms to seek price competitiveness. At some point China will have dealt with COVID so supply can resume, shipping backlogs will ease, and energy prices will come down. In the meantime, however, central banks need to normalize and part of that will mean higher risk premiums across all asset classes. So, don’t expect a return to bull markets soon.

Disclaimer

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

It has been established on the basis of data, projections, forecasts, anticipations and hypothesis which are subjective. Its analysis and conclusions are the expression of an opinion, based on available data at a specific date.

All information in this document is established on data made public by official providers of economic and market statistics. AXA Investment Managers disclaims any and all liability relating to a decision based on or for reliance on this document. All exhibits included in this document, unless stated otherwise, are as of the publication date of this document.

Furthermore, due to the subjective nature of these opinions and analysis, these data, projections, forecasts, anticipations, hypothesis, etc. are not necessary used or followed by AXA IM’s portfolio management teams or its affiliates, who may act based on their own opinions. Any reproduction of this information, in whole or in part is, unless otherwise authorised by AXA IM, prohibited.

AXA IM and BNPP AM are progressively merging and streamlining our legal entities to create a unified structure

AXA Investment Managers joined BNP Paribas Group in July 2025. Following the merger of AXA Investment Managers Paris and BNP PARIBAS ASSET MANAGEMENT Europe and their respective holding companies on December 31, 2025, the combined company now operates under the BNP PARIBAS ASSET MANAGEMENT Europe name.