Why Inflation-linked bonds are “persistently” attractive

Key points:

- Despite the disinflation process, the outlook for inflation remains volatile

- Interest rates are in restrictive territory

- Inflation-linked bonds continued to outperform their nominal counterparts and still offer a good trade off between duration and sticky inflation

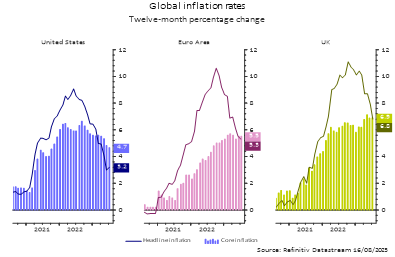

After last year’s peak, total inflation has been falling across advanced economies mainly result of lower oil prices. However, core inflation is stubbornly above the 2% target, giving central banks (and fixed income investors) a hard time.

No doubt market sentiment has been dominated by two different themes in 2023: inflation persistence and the timing of the end of the hiking cycle. Multiples are the reasons behind the stickiness in inflation: tighter labour markets, consumer spending resilience, higher fiscal deficits, ongoing supply chain disruptions. Also, the recent uptick in commodity prices is adding upside risks to headline inflation in the short term: the outlook remains volatile, even if we don’t expect inflation to materially reaccelerate.

Source: AXA IM, Refinitive Datastream as of 16 August 2023

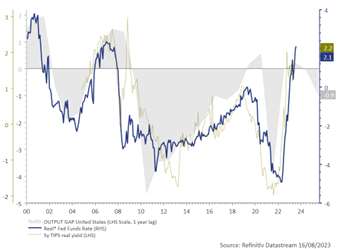

Central banks across advanced economies have in consequence pursued the fight against inflation, hiking rates by at least another 100 bp this year. In our view, this additional tightening has brought interest rates into restrictive territory. Real yields are now in positive territory for the first time since the Great Financial Crisis and the transmission of higher rates into the economy should be translated into subdued growth over the coming quarters, as it has been the case for the past decades.

Source: AXA IM, Refinitive Datastream as of 16 August 2023

In this context, we believe that inflation-linked bonds offer an interesting value proposition. First, as economic activity decelerates, real yields should rally as they are a long-term proxy for real growth. At the same time, with inflation breakevens hovering around 2%-2.5%, it seems that there is little inflation premium in current valuations. We see this market mispricing of future inflation, as an opportunity to lock in higher yields at attractive values while protecting against upside risks for inflation.

Despite higher rates and lower total inflation, inflation-linked bonds have outperformed their nominal counterparts since the beginning of the year

Disclaimer

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales No: 01431068. Registered Office: 22 Bishopsgate London EC2N 4BQ

In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.

AXA IM and BNPP AM are progressively merging and streamlining our legal entities to create a unified structure

AXA Investment Managers joined BNP Paribas Group in July 2025. Following the merger of AXA Investment Managers Paris and BNP PARIBAS ASSET MANAGEMENT Europe and their respective holding companies on December 31, 2025, the combined company now operates under the BNP PARIBAS ASSET MANAGEMENT Europe name.