UK Budget reaction: Doing the RIGHT thing

- 07 March 2024 (7 min read)

Still a pre-election Budget

Chancellor Jeremy Hunt delivered only his second full Budget today. The backdrop for the Chancellor had been challenging with a resumption of rising borrowing costs from the start of the year and weaker growth increasingly eroding the Chancellor’s fiscal space and room for manoeuvre. Moreover, with an expected General Election later this year and with the ruling Conservative party currently trailing heavily in the polls – 27 points in the latest IPSOS/MORI poll - the Chancellor faced additional clamour from the backbenches to provide tax cuts to boost Tory ratings and provide a lift to approvals going into the election.

The Chancellor continued the easing he had started with the 0.5% GDP loosening in November’s Autumn Statement. With a well-trailed freezing of the fuel duty and 2ppt further reduction in National Insurance, net new measures saw spending of an additional £14 billion this year and £11 billion next, totalling close to £50 billion over the forecast horizon. This degree of easing was far in excess of the projected headroom in the November Statement. But the Chancellor was afforded greater manoeuvrability this time driven by a sharp fall in forecast debt interest payments, providing savings of on average £13 billion per annum. Moreover, the Chancellor announced a range of tax increases from taxing vaping products to adjusting the non-domicile tax system, a policy borrowed from the opposition Labour Party’s toolkit. The Chancellor also modestly tightened spending beyond this year, to be delivered – if polls are to be believed – only by his successor.

The net easing from this Budget is modest and will likely provide only a marginal boost to an economy in recession at the end of last year, although we have raised our GDP forecast by 0.2ppt for this year and next on the back of it. As such, this Budget is unlikely to impact the projected path for Bank Rate and it also seems doubtful we will see much of a boost to the Conservatives in the polls.

Over the weekend, Chancellor Hunt had said it was important to “do the right thing” with regards to the public finances. It is a broader question whether he achieved this. Pre-Budget discussion had focused on the Chancellor’s fiscal headroom. We argue that this is a buffer against forecast revisions – which Chancellor Hunt has consistently run lower than any Chancellor since the Office for Budget Responsibility began – not a repository of further funds. We argue that with the OBR forecasting relatively optimistic growth assumptions from here and suggesting only a 54% chance of meeting the target despite that, there is a good chance that the finances will deteriorate somewhat from here.

That said the Chancellor may have managed to “do the right thing” by facing down calls for even more tax cuts funded by increasingly unrealistic fiscal tightening for a future government to deliver. There is also merit in the rebalancing of taxation to broader income tax, still underway with the freezing of tax thresholds that will continue to underpin a rising overall tax take as a proportion of GDP over the coming years, with the reduction in National Insurance. However, today’s Budget still appears one more designed with the upcoming election in mind than the wellbeing of the UK public finances and the longer-term economic interests: A Budget still skewed more towards doing the RIGHT thing, than the right thing. But in striking a workable balance, Chancellor Hunt risks disappointing both sides of the debate.

Measures – focusing on personal tax cuts

The policy measures announced in the 2024 Spring Budget were largely as expected, with the Chancellor having to walk a fine line between providing a much-needed political boost and upsetting bond markets, as was the case in the mini-Budget in the latter half of 2022. As anticipated, the major announcement was the further reduction in Class 1 employee National Insurance Contributions for employees to 8%, from 10% from the 6th April and the equivalent reduction in Class 4 NICs for the self-employed, to 6%, from 8%. But the Chancellor also announced an increase in the income threshold for the high-income child benefit charge to £60K, from £50K and lifted the taper range to £60K to £80K. Taken together, these policy changes are estimated to boost labour supply by an additional 100K, on top of the 200,000 boost from the childcare and NIC policy changes already announced.

The Chancellor also made a few tweaks to the UK tax system, the most significant being the reforms to tax paid by so-called “non-doms”. Indeed, from April 2025, the Government aims to replace the existing regime with a new relief on foreign income and gains available for the first four years of UK tax residency, which should raise around £9 billion over the forecast horizon. The tax on vaping products and one-off hike to tobacco duty alongside the HMRC anti-avoidance measures and the one-year extension to the energy levy, meanwhile, will raise around £3.9 billion. Nonetheless, the tax burden still is set to rise to 37.1% of GDP in 2028-29, 4.0% higher than the pre-pandemic level.

Finally, several measures look set to improve the outlook for Consumer Price Index (CPI) inflation. As expected, the 5p cut to fuel duty was extended by 12-months, while the increase by RPI was postponed again until at least 2024-5. And the freezing of alcohol duty was also extended out until February 2025. Together, the OBR judges these policies will reduce the outlook for CPI inflation by 0.2pp in 2024-25.

The economy – rosy forecasts underpin finances outlook

Alongside the improvement in the outlook for debt interest payments, upward revisions to near-term real GDP growth likely helped pave the way for the further loosening in today’s Budget. The outturn in 2023 was weaker than the OBR had expected; the UK economy grew by just 0.1% in 2023, 0.4pp below expectations. But the OBR is more optimistic on the near-term outlook reflecting a faster-than-previously-expected decline in interest rates and a stronger recovery in real incomes. Indeed, it now has growth picking up to 0.8% and 1.9% in 2025, compared to the forecast in November’s EFO, 0.7% and 1.4% and 2.0%. Note the 2026 forecast remained unchanged at 2.0%.

We doubt economic activity will recover that quickly, though. Despite the improvement in consumer confidence in recent months alongside the recovery in real incomes, we are yet to see signs of a material pick up in households’ consumption. We suspect this is largely because monetary policy is operating with longer lags than most assume, meaning the full impact of the previous tightening cycle is yet to be felt. On top of this, the OBR has more Bank Rate cuts factored into its current framework this year than we anticipate; they expect the first 25 basis points (bps) cut to be pushed through in Q2 with a further 75bps of cuts pencilled in by year-end, compared to our expectations for the first cut in August and then two further 25bps cuts. That said against a backdrop of easier inflation and some loosening in personal taxation, we lift our GDP forecasts modestly to 0.4% this year (from 0.2%) and 0.8% next (from 0.6%), still much closer to the BoE’s gloomier forecasts than the OBR’s rosy outlook.

Further ahead, the OBR’s projections on trend growth also appear overly optimistic. Indeed, the OBR’s 1.8% estimate of trend growth - well above the actual pace seen in the latter half of the 2010s. While the upward revisions to ONS’ population projections will provide some boost, we think the outlook for productivity is consistently too high given the malaise in business investment over the past decade or so. The upshot is that the tiny £8.9 billion headroom would be wiped out if growth increases in line with our softer expectations.

We are, however, more in line in our outlook for inflation. The OBR forecasts the headline rate of CPI inflation averaging 2.2% this year, dropping below target in Q2, then falling to 1.5% in 2025, before ticking up to 1.6% in 2026. Our own forecast is to see inflation at 2.4% this year factoring in a small uptick in the second half of the year then falling in line with the OBR’s expectations in 2025 and 2026.

The public finances – on target – just

The Chancellor announced a material fiscal loosening of £14 billion (0.5% of GDP) next year, with an ongoing loosening of £11.5 billion in 2025-6, £8.5 billion in 26-7, £6.8 billion 27-8 and £6.4 billion in 28-9. This came despite previous concerns of fiscal headroom due to a material adjustment in the expected level of debt interest payments. These fell back significantly – an average fall of some £13 billion per annum, driven by a materially faster drop in RPI inflation compared to the OBR’s November forecast as well as an estimated lower Bank Rate forecast (around three cuts lower, having the most impact on BoE APF payments) and longer-term gilt yield forecasts which are now seen on average 0.50ppt lower over the forecast horizon. Such an adjustment provided significant scope for additional changes.

By contrast, the Chancellor’s other revenue raising measure described above were relatively small. There was also a further reduction in capital spending, with net investment planned modestly lower in each of the forecast years, falling further in nominal and real terms. Departmental spending was also lowered modestly further in nominal and real terms, although after a quicker near-term downward adjustment, real growth after this year is now forecast modestly higher.

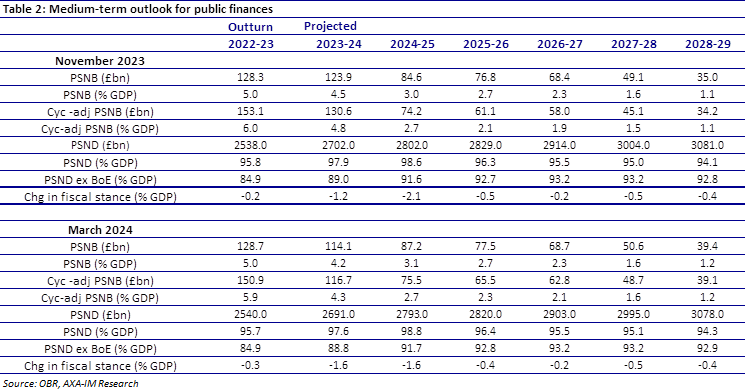

The debt interest reduction benefitted the net borrowing outlook for this year, contributing to a near £10 billion forecast improvement to £114.1 billion. However, the additional announced spending measures served to increase the borrowing profile modestly thereafter, by nearly £3 billion for the coming fiscal year, falling to a smaller around £1 billion for subsequent years until 2028-29, where the difference is £4 billion (Table 2). The net effect of this is to leave the debt level broadly unchanged - 0.3ppt of GDP lower this year, but then expected to peak slightly higher at 98.8% of GDP next year (from 98.6%) and falling to 94.3% (from 94.1%) by 2028-29.

This combined impact has shifted the degree of fiscal tightening envisaged. The lower deficit for this year has increased the degree of fiscal tightening this year to 1.6% of GDP (from an expected 1.2% in November). Looking ahead, this reduced the expected tightening next year also to 1.6% (down from 2.1%). This is still a sizeable fiscal tightening. With the exception of the unwind of pandemic measures, a 1.6% tightening is the largest single one-year adjustment since 1995-96 (where it was 1.8%) and largest multi-year adjustment since 1980-2.

All of this meant that the OBR forecast the Chancellor to be on track to meet his fiscal rules:

- Met: The fiscal mandate, to see GDP (ex BoE) falling by year five of the forecast horizon (2028-29)

- Met: PSNB to be below 3% of GDP by year five

- Exceeded: welfare cap, expected to be exceeded by £7.4 billion in 2024-25, although by lower margin than in November

However, despite meeting the primary fiscal mandate, with debt projected to rise from a current 85% last year to peak at 93.2% in 2026-27 and fall back to 92.9% in the final year of the forecast horizon, the Chancellor does so by a fine margin. The OBR estimates the Chancellor has a buffer of just £8.9 billion (0.3% of GDP) – down £4 billion from November continuing the trend of the smallest buffers held by any Chancellor since the OBR began. As such and given the inherent uncertainty in the fiscal forecasts, the OBR assesses that the government has a 54% chance of meeting the fiscal target (down 2ppt since November) and little more than a coin toss.

Market reaction – few surprises

If anything, we were surprised by how few surprises there were in today’s Budget. Judging by market reaction, this was a view shared by broader market participants – and not an unwelcome outcome for the Chancellor given previous fiscal events. Sterling was broadly unchanged versus the dollar, softening a touch to the euro after the Chancellor started speaking. Short-term monetary policy expectations are barely changed, despite the OBR now looking for around four cuts by the Bank of England both this year and next – ahead of market and our own expectations. However, term yields eased somewhat: 2-year yields eased 6bps and 10-year by 4bps to 4.25% and 4.00% respectively (from the Chancellor speaking until Fed Chair Powell gave his semi-annual monetary policy address). Equities markets saw some boost and the FTSE 100 had increased by 0.4% before Powell started speaking, reducing the gains to 0.1%.

Related articles

View all articles

July Monthly Investment Strategy - One crazy summer

- by David Page, Hugo Le Damany,

- 24 July 2024 (10 min read)

July Op-Ed - Reconvergence

- by Chris Iggo, Gilles Moëc

- 24 July 2024 (10 min read)

Pushing the Walls

- by Gilles Moëc

- 22 July 2024 (10 min read)

The perfect storm: Deglobalisation’s headwinds

- by Olivier Blanchard

- 22 July 2024 (7 min read)

ECB Review: No commitment, no guidelines, no…thing

- by François Cabau, Hugo Le Damany

- 19 July 2024 (3 min read)

Disclaimer

This market comment should not be regarded as an offer, solicitation, invitation or recommendation to subscribe for any investment service or product and is provided for information purposes only. No financial decisions should be made on the basis of information provided.

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

It has been established on the basis of data, projections, forecasts, anticipations and hypothesis which are subjective. Its analysis and conclusions are the expression of an opinion, based on available data at a specific date.

All information in this document is established on data made public by official providers of economic and market statistics. AXA Investment Managers disclaims any and all liability relating to a decision based on or for reliance on this document. All exhibits included in this document, unless stated otherwise, are as of the publication date of this document.

Furthermore, due to the subjective nature of these opinions and analysis, these data, projections, forecasts, anticipations, hypothesis, etc. are not necessarily used or followed by AXA IM’s portfolio management teams or its affiliates, who may act based on their own opinions. Any reproduction of this information, in whole or in part is, unless otherwise authorised by AXA IM, prohibited.

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales No: 01431068. Registered Office: 22 Bishopsgate London EC2N 4BQ. In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.